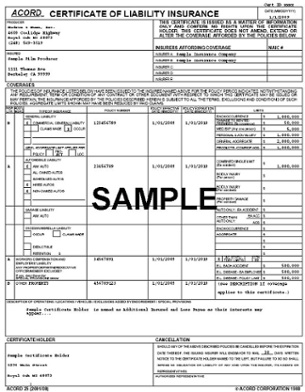

A certificate of insurance is a one pager that provides policy details on your liability insurance coverage, verifying that you have the professional liability insurance, general liability insurance, or business owners policy you claim to have. The details it shares include the types and limits of coverage, the issuing insurance company, your policy number, the named insured, and the policy’s effective dates

Sometimes referred to as a certificate of liability insurance or accord certificate of liability insurance, it is often required by your landlord/lease agreement or in order to win contracts. This way, your potential client can know for sure whether you have business insurance. Many companies and individuals that hire contractors need to know that they won’t be held liable for damages, injuries, or substandard work, and therefore require that you have insurance.

Don’t be alarmed if the client also requests that they be added to your certificate as a certificate holder. This is a common request, and complying does not give them any legal rights under a certificate, because the certificate simply establishes that an insurance policy exists

Most online certificate requests will be completed within 24-48 hours. For an immediate need please call our office between the hours of 10am-6pm EST M-F.

- Proof of Insurance – The certificate holder only wants to verify that coverage exists on the policy. The certificate holder has no insurable interest and is not granted coverage by the policy.

- Additional Insured – The Certificate Holder has requested to be named as an additional insured on the policy for liability purposes.(Adding an additional insured to your policy may change your premium.) A third party other than the named insured who is covered by the policy. Usually, additional insureds are added to the policy by endorsement. Additional insureds may be referred to in the policy definition of insured. An example of an additional insured is a sub-contractor doing work for a general contractor. The general contractor would be an additional insured on the sub-contractor’s policy. There may be additional premium charged when an additional insured is added to the policy.

- Loss Payee -The Certificate Holder has an insurable/financial interest in the property. The Property IS NOT a building.(e.g. a bank financing an insured vehicle) The party to whom money or insurance proceeds is to be paid in the event of loss, such as the lienholder on an automobile

- Mortgagee – The Certificate Holder has an insurable/financial interest in the property. The Property IS a building.(e.g. a bank financing an insured building)The party to whom money or insurance proceeds is to be paid in the event of loss of the property, such as the lienholder (typically a bank) on a building. The property MUST be a physical building or site.