- April 1, 2016

- Posted by: Liam Dai

- Category: Pet Insurance

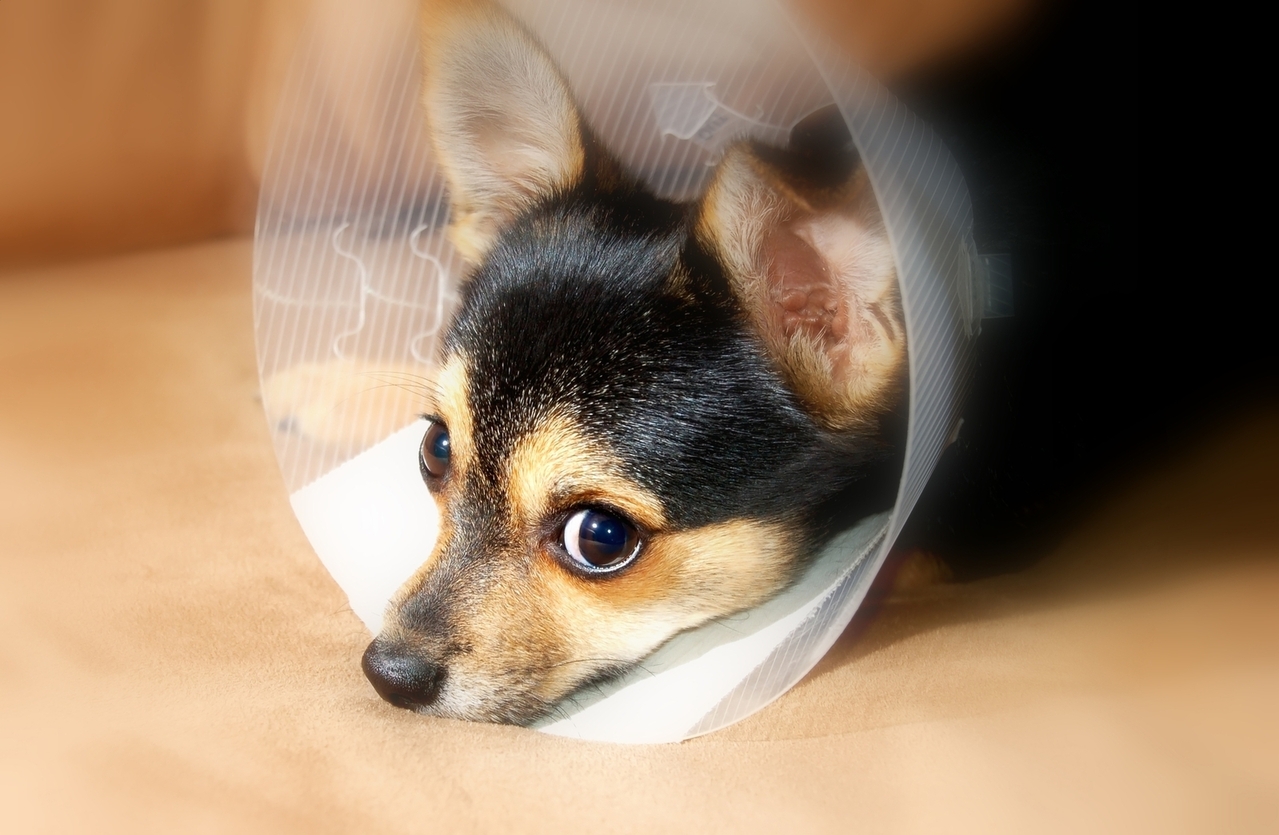

If you have a pet in your home, you know that there’s no difference between your fur baby and your family. While you take care of their immediate needs, everyone knows your pet’s long-term health needs to be looked after, too. Veterinarian bills can be expensive, so to be fiscally responsible, it helps to have pet health insurance. Curious to know more? In this article, we’ll figure out what is pet health insurance and why our pets deserve it.

Pet Health Insurance

Simply put, your pet is recognized by the law as property. Hence, pet health insurance is a form of property insurance. It also is peace of mind, knowing that should something occur with your pet, you won’t be subject to sticker shock from expensive procedures—or worse, having to euthanize your animal because you cannot afford vet bills.

What makes pet health insurance different than human healthcare is that are responsible for all upfront costs, which you then submit to your insurer for a reimbursement. Some veterinary offices may assist you through this process, while others consider it part of your responsibility.

Factors Affecting Pet Health Insurance Coverage

Unfortunately, not all pets are equal to insurers. Before signing up your pet for insurance, be aware that insures have some restrictions and limitations.

- Waiting Period: New policies usually have a mandatory waiting period for your pet, effective from the sign-up date when you cannot access the policy’s benefits. Usually, this is between 3 days to a month afterwards. Injuries and illness during this period may not be covered after the waiting period.

- Age: Animals that are very young and ones that are towards the end of their expected lifespan usually aren’t eligible for coverage.

- Pre-Existing Medical Conditions: If your animal has a pre-existing condition, it may affect your pet being accepted by an insurer. Curable diseases (ex. UTI) don’t immediately exclude your pet from consideration, but long-term illnesses (ex. diabetes) may disqualify you.

- Dental: Teeth cleaning is usually covered, but many insurers don’t cover more invasive dental procedures, like tooth excavation.

- Reproductive Health and Breeding: You are usually required to disclose whether your animal will be used for breeding for coverage.

- Expensive/Novel/Cosmetic Treatments: Some procedures that may be considered non-essential or needlessly expensive, such as a prosthetic leg, are typically restricted depending on the insurer.

- Deliberate Injuries and Fighting: Insurers typically turn away animals that are used for racing or fighting—or worse, abuse.

- Basic Standard of Care: Insurance companies typically require a “basic standard of care” to remain on their policy. This includes, but isn’t limited to shots, vaccines, and health.

- Death expenses: Pet health insurance policies for the death of your pet are rare. Instead, if you may want to seek private insurers to handle funeral, burial, and cremation costs.

Why Do I Need Health Insurance for My Pet?

While we purchase animals knowing that one day they won’t be among us, the decision to purchase a pet health insurance policy ultimately is a financial AND an emotional decision. No one wants to see their loved ones suffer, but we know that pet owners feel forced to place a monetary limit to their pet’s “value.” Keeping our pets alive unfortunately cannot come at the expense of our own well-being—or our family.

This is where consulting a qualified insurer like RiskBlock can give you peace of mind, offering a solution that guarantees unparalleled coverage without compromising your budget. Click here to begin finding a solution that fits your furry loved ones.